The AS guide to company analysis

Another weekend another unpredictable political bingo, this time in France. I have a lot to say about this, but little of it has any value because like most of you, I have no particular insight into what the final outcome will be. My suggestion, buy some good French cheese and a nice bottle of Vacqueyras, sit back and just let it happen.

It would be pointless for me to go through my views on the market in this context. Instead, I thought that I would do a bit of legwork on company analysis. I don't often present this part of my work here, but I thought that I would make an exception. Think of it as an alternative way to look at the headline fundamentals, compared to what you see by the sell side. Picking the companies to analyse is an art in itself—in the sense that you can't look at everything—so I thought that I would run the charts and analysis for Johnson & Johnson, a stalwart U.S. blue chip value and dividend aristocrat. It's a good benchmark for this type of analysis, because it has a long and well-updated history of data, and because it will be easy for you to judge the analysis given the tons of information already available on this firm.

Should we pay a premium for non-cyclicality?

I am a macroeconomist, so one of the first questions that I want to answer is whether the firm in question is cyclical. This question can be answered in a dozen ways; I have chosen to compare year-over-year price changes in the price with year-over-year changes in G4 nominal GDP growth. The first chart below shows the benchmark—the S&P 500 in this case—and the second shows JNJ. I have used both a linear and a non-linear—squared—fit for reasons, which will be obvious when you look at the second chart.

As expected, price changes in the S&P 500 have a fairly consistent cyclical component although the R-square is only about 0.2, so even if you could spot-predict global GDP growth, it wouldn't always help to time U.S. equities. The second chart, however, suggests that JNJ is not cyclical at all. If we look at periods where GDP growth has been between 2% and 5%, JNJ has produced annual returns all over the place. By contrast, the non-linear specification reveals that JNJ is not recession proof. In the few instances where G4 GDP growth has been falling rapidly year-over-year, returns of JNJ have been pulled below zero too. This hasn't happened that often, though, and if you isolated that period I doubt it would be statistically significant. JNJ also appears to have a tendency to produce negative, or low, returns in period of very high global GDP growth. That is odd when you consider the business it is in, and I struggle to come up with an explanation. I suspect it is because JNJ tends to lag early in the recovery phase where GDP growth accelerates sharply from a low point, but I need to look closer on the data to verify this. The final question is whether the apparent non-cyclicality of JNJ is something we should pay a premium on? Perhaps, but only up to a point. Remember that the key point above was that JNJ is not recession proof. I doubt anything is really.

Are JNJ's Margins sustainable?

Equity analysts will spend ages analysing the fundamentals of a company. But I think the state of play is pretty simple. Is the company in question making money and if so, is it accruing to shareholders via a strong return on equity/capital or dividends/share buybacks? It is not necessarily a huge problem if it isn't making money, but we then need some assumptions about whether it will in the future. Similarly, if it's making money but not producing returns to shareholders—I am looking at you Japan—we also need to understand why, and whether it will change.

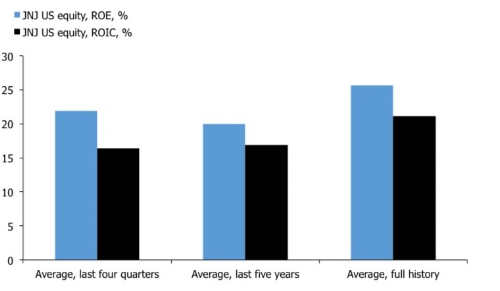

Analysing these metrics for JNJ is a luxury because its historical fundamentals are rock-solid. But let's see whether we can't find some weak spots. The first chart shows historical values for ROE and ROIC and the second shows a long-run overview of sales and EPS growth.

It's difficult to have any objections about the historical ROE and ROIC here. Sure, the recent performance is slightly worse than the long-run history, but an ROE of about 20% is impressive, especially if we consider the nature and size of the business, and the historical average we're talking about in this case. The consistency of positive growth in top-line and earnings also is pretty spectacular. Obviously, there is a cyclical component, but the second chart shows that earnings rarely fall on a year-over-year basis. In addition, we see that in periods of falling sales, EPS growth has held up much better, signifying strong discipline and fundamentals with respect to margins. Since the financial crisis, however, growth in sales and earnings has dipped. This is not surprising given the structural decline in headline GDP growth, but it is slightly worrying to see that margins did not hold up during most recent fall in sales and EPS growth. The next chart shows why this is important.

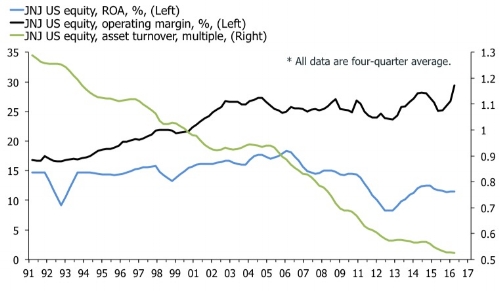

Financial analysis 1-o-1 teaches us that return on assets—or equity if you include a leverage multiple—is a function of two drivers; asset turnover, which measures revenue as a share of total assets, and operating margins. The chart above shows that asset turnover as declined steadily for JNJ throughout the period we have data for. This means that the firm's assets has grown faster than revenues, and the only way that you can keep returns in that instance is if you expand margins. Well, as far as I can see JNJ has been a true master in that. The operating margin was trending up from 1990 to 2000, then flat-lined, and then has trended up again since 2012. It hasn't been enough to prevent a gentle decline in return on assets—JNJ is a very mature company after all—but it has certainly helped. If I was digging further into JNJ I would spend most of time examining whether its margins are sustainable, and indeed whether it can increase them.

A corollary to the numbers above is whether JNJ produce free cash flow and pays a dividend. The answer in this case is a resounding yes, and I stress that these data are not representative for the general stock out there. This is JNJ after all. The first chart below shows growth in free cash flow-per-share and the free cash flow yield. Naturally, growth in free cash flow fluctuates but if we look at the free cash flow yield through history, it's been pretty solid. Even in the darkest hours, there has always been free cash flow available to give flexibility to management. As a result, JNJ also has been a very steady dividend payer. The second chart below shows that the dividend yield has been increasing steadily over time, despite the decline since 2012. It also shows that this has been the case against a backdrop of a relatively modest payout ratio.

It's all well and good to find a company that's making money and paying a dividend, but if it is doing this by issuing debt and stressing the equity, it's not clear that we should become shareholders. This is a particularly important aspect in this cycle where many companies, especially, in the U.S. have dragged their balance sheets through the mud, buying back shares and paying dividends mainly via levering up. This is great as long as rates are low, but if that story changes reality will set in quickly. JNJ, however, emerges relatively unscathed in this case. The first chart below shows that net debt-to-ebitda has been consistently below zero—i.e. a net positive cash position relative to the bottomline—and the debt-to-equity ratio is just under 40%, which is un-demanding. I would hold this to be true despite its significant increase in this business cycle.

What is "fair value" anyway?

Up until this point my analysis probably haven't deviated much from what equity geeks would look at. Often, however, it is when it comes to valuations and the question of "cheapness" that I struggle to follow the industry's methodology. In short, I think equity analysts spend way too much time on forward looking earnings/projections. I understand the pressure to have a "view," and to use a forward-looking methodology. But the idea that the equity market trades based on "forward earnings" belies the fact that earnings forecasts are bound to be hugely uncertain. In other words, if that is indeed the case the market is way more stupid than we think, and I struggle with that assumption. After all, beating the market isn't that easy. Even with the data history available for JNJ, I think I would struggle to come up with a statistically significant estimate for earnings. I am much more interested in where a company, or an index, is trading relative to what it has done in the past. At least I would ascribe just as much important to that in making my decision on whether to invest or not.

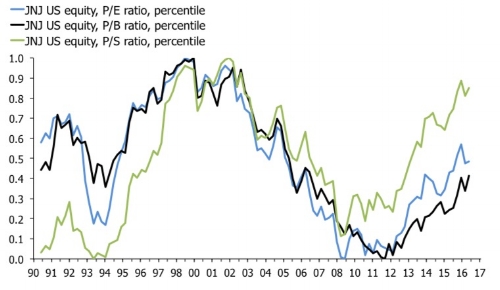

JNJ stacks up pretty well actually. The first chart below shows the z-scores [1] of the four main valuation multiples. The second shows their percentiles over time.

JNJ looks slightly expensive based on its trailing price-to-sales ratio, but is otherwise fairly valued, which is remarkable given the historical valuations other parts of the market is trading at. This story is repeated if we look at the time series. The P/S ratio looks extended, but the other rates are poised around the "average" of 0.5. The problem, though, is that it isn't easy to discern any mean-reversion here. Or at least, mean-reversion appears to happen over very long periods. In this sense, we can say that multiples certainly could expand much more, but that is based on a sample size of one in the dot-com bubble. Perhaps, that is not the best bet.

The question of mean-reversion in valuation multiples, or lack thereof, is a bit a pet peeve of mine, especially in the context of firms, or markets, where have a long data history. In essence, if multiple do not mean-revert over time or over the cycle, we need to have a long hard thing about why that is. Think about a firm whose P/E multiple is trending up over a ten-year period. In the main, this is uncontroversial. It simply signals that the market believes the firm in question will continue to exhibit strong growth or continue to take market share. Amazon is probably a good example here. A similar story can be told if we consider a firm whose multiple is declining over time, the classic value trap that continues to look cheap based on its historical fundamentals, but actually isn't.

The smug equity analyst would note here that this is exactly why you need to consider forward earnings and forecasts. I concur. But I still think the profound implications of "trending valuations" is something that is too often forgotten when it comes to equity analysis. What we can say for certain is that valuing anything based on its historical valuations is much more difficult if multiples are trending up or down. I think the confusion around this is one of the main sources why so many people have been disastrously wrong on the U.S. equity valuations using the CAPE ratio and similar measures. If you look at these indicators they exhibit long trends, and even appears to edge higher over time.

Econometrics gives us all kind of wizadry to de-trend variables which could be useful in the context of equity multiples, but for now lets stick to valuation based on the past. My trusted valuation score is especially designed for that, and has a decent fit with JNJ, as you would expect given the mature nature of the business in question.

The score currently signals that investors are best served waiting a bit if they would like to hold JNJ as part of their portfolio, or add to their positions. This is consistent with the message from the same model with the S&P 500 and the MSCI World. I like this framework because it allows me to trade a security based on a standard strategic perspective of about six-to-nine months, and provides useful points to enter or trim positions in stocks that you already own. In general, I don't do anything in the equity market without consulting this model.

Should you own JNJ then? Well, if you own a U.S. equity ETF, chances are that you already do. Beyond that, I will defer to my position on the French elections. I don't know. But if you must, my shout is to wait until the beginning of Q3 to make your move.

--

[1] - A z-score is a normalised measure of a time series which allows us to turn pears and apples into comparative measures. My score takes the average value of the recent quarter, less the historical median divided by the historical standard deviation. In theory, you could normalise with higher order moments, but I struggle to see why you would do that.