Can the Illusion be Sustained?

Another week, another hand grenade thrown in U.S. politics and international affairs. President Trump and his advisors believe they have the wind in their sails, and they're determined to make as much headway as possible. We all have our opinions on this, but as investors we need to keep our eyes on the ball. And the situation is getting interesting. Spoos are up 23% since the lows of the Q1 panic in 2016, and it has soared 10% alone since Mr. Trump snatched the elections. With the Dow finally breaking the 20,000 mark, Barron's have simply decided to reset the clock.

It has been called the "Trump rally," which begs the obvious question. Can it continue in the face of the increasingly controversial policies streaming out from the White House? It's virtually impossible to gauge when/if the "Trump factor" becomes a net-negative for financial markets. I suspect, though, that those hoping that Mr. Trump will make America Great Again are having a re-think. After all, we have seen plenty of all the bad stuff, but very little in the way good stuff such as infrastructure spending and tax cuts.

If you're not willing to take bet on politics becoming adversarial for markets, the picture from market indicators is murky as ever. But I would argue that the strategic dashboard is flashing amber, if not red, for equities. One of the clearest signals is that the risk/reward is becoming more favourable for a strategic rotation into bonds at the expense of equities. In other words; to fade the reflation trade. The first chart below shows three-month stock-to-bond returns in the U.S. which are pushing 12%; that's not extreme, but it's high enough to get me interested. The second chart shows my valuation score for U.S. 10-year bond futures, pointing to higher returns.

Leftback once again advised punters to buy the dip in fixed income. His point in a nutshell is that markets probably have been carried away in its expectations of surging GDP growth in the U.S.

"Here at Falling Knife Capital, we still think that Mr. Bond will have a soft landing this time. In fact, now that the Inaugural is behind us, with all of its “Sound and Fury signifying nothing”, Mr. Market will likely undertake a more cerebral evaluation of the likelihood of 4, 5 and 6% US GDP in 2017."

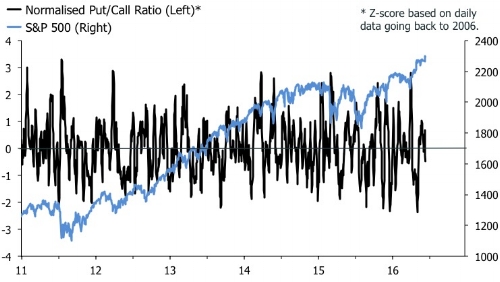

I would argue that political machinations so far by the U.S. administrations suggest that this probably is a good bet. Tactical indicators on equities, though, are not completely in sync with the idea that equities are about to hit the skids, unless of course you think that a Vix around 10 is dangerous in itself (hint: it isn't!). The put-call ratio for example is currently not sending a convincing message of anything. It's below zero, but far from previous extremes. What is perhaps most interesting with this gauge, though, is that the collapse in December, which suggested markets would have a poor start to the year, didn't seem to have had any impact on investors' appetite for risk.

The message from my breadth indicators is a tie. The first chart below shows that the net new highs on a 52w basis has popped back above zero in recent weeks. The market usually has been a difficult short when that has been the case. The second chart, however, shows that the advance-decline ratio has faltered even as the market has climbed. Usually, this is an ominous signal for the equity market.

The question of hedging or fading the rally via a tactical short also has been vigorously discussed last week in a small group of investors that I am lucky to be part of. I am never sure exactly what the conclusion is when we have one of those debates, but one piece of evidence that jumped at me was the surge in insider selling as reported by Barron's.

I am pretty sure that backtests based on these "contrarian" insider-transaction indicators almost exclusively are a wash. I wouldn't use this is a smoking gun in any way. But it's an interesting observation given that the major story for equities is the belief in Mr. Trump's ability to jump-start growth and make America great again. It is, at least, a little worrying in this regard that corporate officers don't appear to have a lot of faith in that story.

Is the wall of worry getting slippery?

As so often before in this cycle we find ourselves with a nearly perfect storm of market-based indicators and political shenanigans pointing to a sell-off in the equity market. We should remember, though, that such occurrences appear to have been the primary fuel for the market to push higher. The road in Spoos from 666 in March 2009 to about 2300 today is paved with the bones of those singing the siren song of a top. I won't be the one ringing the bell at the absolute top. I suggest that you visit your local numerologist if that is what you're looking for. What I will say, however, is that the dissonance between the reality and perception is now glaring. On their own, market indicators suggest that the reflation trade is getting tired. More worryingly, though, is the idea that the equity market is rallying because of the assumption that Mr. Trump will campaign in poetry, but govern in prose. It is increasingly clear that this is not the case, and I wonder how much longer investors will entertain the illusion that he is.