Will the evil eye of Mr. Market still focus on DB this week?

A catalyst? How about speculation of a Lehman moment at DB? Would that work sir?

It is a public holiday in Germany on Monday and that is probably a good thing. But that won't prevent the hot takes on Deutsche Bank from piling up faster than Donald Trump's tax liabilities. I am lucky to have a lot of friends on the buy-side as well as strategists at major sell side shops, and the debate between us has been lively in recent days. But we are no closer to a conclusion and neither, it appears, is the market given the ridiculous price action on Friday. The grapevine has it that the DOJ will lowball the fine, which should allow DB to stagger along in accordance with its original 2020 plan. But the results on October 27th will be a key event in either case. A bad downside surprise could bring coupon payments on the COCOs in danger, at least as far as I understand. I concede, however, that I have no strong take on whether this is indeed likely to happen.

But I think that I can make a couple of relevant points. Waiting for, or betting on, a liquidity event at DB is futile. Remember the Greek banks that effectively went bust, but were kept alive via the ECB's ELA? DB is systemic, has a loan-to-deposit ratio well below 1, and plenty of liquid assets. I highly doubt that counterparty risks are relevant here, despite the much-cited stories of hedge funds moving money elsewhere. If DB had to seek refuge in the ECB's skirts for any amount of time, the call for some kind of recap would increase very quickly. In fact, state-support solution for DB is looking increasingly inevitable in some form or the other. it follows, I think, that any solution on DB would be the blueprint for other big banks in the EZ. In short, DB's woes bring a EZ TARP closer, but the road from here to there is paved with pain and volatility. Finally, the rather lazy "trade" in all of this is to hide out in DB's senior bonds, at least according to the sell-side analysis I have seen. You know, retreat to the mother ship and all. I suppose this makes sense. These things are, in theory, exempt from bail-in until Jan 1st 2018. Be careful, though. If things get feisty I suspect all bets are off and I think that, if Merkel has to step in, all DB's investors will be headed for the hairdresser with "jarhead" as the only option on offer.

How to work off excess by moving sideways

Enough with DB then. In any case, and despite the best attempt by the peanut gallery to kick up a fuss over an imminent "Lehman moment," equities have been moving sideways. One of the most valuable lessons that I learned from sitting next to traders is that overbought and -sold conditions often are worked off by the index moving sideways; to maximum frustration for the "contrarian" punter. I concede that the current churn could be an example of this. The MSCI world has come back about 1.7% from what looked like a promising break lower a couple of weeks ago. But my models suggest that risks lie ahead, and I doubt that it will climb much further before it heads lower. I remain of the view that risks are tilted towards a break to the downside in Q4.

Will global equities break lower in Q4?

Another thing that worries me a bit is that my breadth indicator for Spoos has rolled over. To be fair, this index is choppy, and I always give it some time to settle when it breaks above or below the zero line. In this case, though, it has stayed below for a while which usually signals that the market is on thin ice.

Internals of U.S. equities are looking wobbly

Meanwhile as noted last week, the looming U.S. elections and endless series of hits to political uncertainty in Europe have pushed EMs back to the forefront on investors' mind. Let's be clear, though, that this story isn't news at this point. At least in equity space, EMs have smashed their developed market peers this year. The MSCI EM is up 14% year-to-date, which compares with a paltry 6% for the S&P 500 and -6% for the poor MSCI EU ex-UK. Indeed, if you look at some of the really beaten down EMs last year—Brazil, Argentina etc—the divergence is even stronger.

The key story here, however, is not that EMs are attractive because of relative valuations. Arguably, they are. But that an argument also can be made that political uncertainty is now lower in these erstwhile hotbeds of non-economic risks. So what's the story here? Well, I had prepared a chart with the Baker Bloom and Davis economic uncertainty index for the U.S. the Eurozone, and EMs proxied by China, India and Brazil. But it all went wrong due to unstable Bloomberg access, so you'll have to wait. Bottom line, though, is that as far quantitative scores go, there isn't much to suggest that economic uncertainty in EMs have come down that much.

Whatever the argument on political risks as an added sweetener for allocating to EMs, my bet is that you will get a chance to buy at a lower level. My valuation score suggests that the recent loss of momentum in six-month return will continue.

EMs heading lower despite investor optimism?

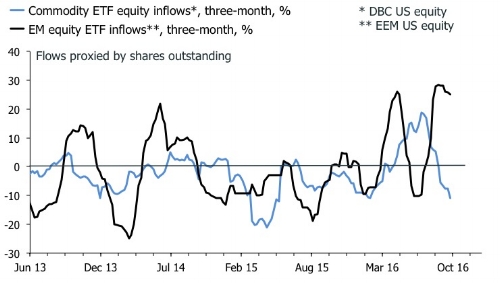

This adds to my general reluctance to aggressively add risk at the moment. Moreover, recent flow data also advise caution on EMs. The three-month change in shares outstanding of the EEM US equity has surged recently, and mean-reversion probably requires a decline. Conversely, inflow into one of the key iShares commodity ETFs has plunged, so maybe that's the Q4 trade? Long physical commodities, short the EM equities that derive value from them.

Fade optimism on EM equities in Q4?

Another story that has been pounded by strategists recently is to fade the outperformance of cyclicals relative to defensives. "Safety first" seems to be the refrain, which is always a good sell I suppose. I do wonder, though, whether defensives such as they are normally understood by the equity strategists, are "safe" in a world where the "reach for yield" is prevalent. The case for piling into defensives over cyclicals also isn't that convincing in my view, at least not if you look beyond a short-term tactical trade. The next chart shows the relative performance of the traditional cyclicals versus defensives in the MSCI World guise. Sure, cyclicals have had a pop recently, but couldn't you reasonably bet on further upside?

Can cyclicals continue to outgun defensives?

I think the key sector-story has to be told elsewhere. One of the trades earlier this cycle was to be long consumer sectors relative to energy and materials. The crash in oil prices and the slump in global commodities via deflationary pressures in China created a massive transfer of wealth from producers to consumers and equity strategists were quick to spot the trade. It was a good one too, but as all good trades it eventually reversed. Now could be a good time, however, to revisit the idea of outperformance of consumer sector stocks relative to energy and materials. At least, that is a plausible interpretation of my final chart. I think that investors are heavily positioned for upside surprises in Q3 and Q4 earnings in the commodities and energy sector. It makes sense too given the very easy comps relative to 2015, but I wonder whether the whole thing hasn't already been priced in.

Be careful about narratives; the data tell a story too

This week is a fairly quiet one on the data front in my part of the market. French and German manufacturing data on Thursday and Friday, though, will bring us a big step closer to a reasonably accurate EZ GDP number for Q3. Elsewhere, I assume that DB will continue to whipsaw the market, but I also think that a settlement with DOJ, however harsh or benign it may be, is coming sooner rather than later. That should bring a measure of "closure." As always with these things, the best thing that could happen for DB right now is for some other drama to hit the centre stage. The market works a bit like the evil Eye of Mordor here; it tends to focus intensely on one thing at a time. As I type this, investors are digesting the news that the U.K. government will trigger Article 50 by the end of March next year. That's earlier than I expected given pivotal German and French elections, but I struggle to see how that is going to be a huge market mover beyond the initial knee-jerk move in GBP. Alas, I think that DB will continue to be the focus of the market's evil eye for the time being.