How to Get it Wrong (Big Time)

It is not often that you come along a piece with which you disagree so strenuously as I do with the analysis fielded by MoneyMorning's Martin Hutchinson on Germany, so when it happens you should of course not miss the opportunity to pick a fight. Now, I should tread carefully here since Mr. Hutchinson is a a man with a remarkable track record as an economic and investment analyst and while I certainly do not want to put myself in the same situation as Niall Ferguson in his infamous tête-á-tête with Paul Krugman, I would still humbly submit the point that Martin is on the completely wrong track here.

Consequently, let us review briefly what it is that Hutchinson is proposing here:

Many commentators have picked the East Asian economies of China, Korea and Taiwan to emerge the most vigorously from the ongoing global financial crisis. And with some justification, for China and the two Asian “tigers” share some alluring characteristics like:

- A highly competitive and innovative manufacturing industry.

- Excellent government and workforce discipline.

- Modest fiscal and monetary stimulus (or, like China, they started from a position of budget surplus).

- And an export orientation that seems likely to benefit quickly as order is restored in the global trading economy.

But there’s another country that shares those characteristics. It’s nowhere near East Asia. But investors can expect this particular economy to also bounce back from this recession with considerable vigor.

I’m talking about the center of supposedly sclerotic Old Europe itself: Germany.

If you add, to this, the headline suggesting how Germany may be the source of emerging market returns with developed world risk you get an exceedingly bullish story on Germany from a macroeconomic point of view. Indeed, all this makes me wonder whether more than a few financial analysts have been spending time in Pamplona as of late. Obviously, Hutchinson writes in the capacity of an investor or specifically one who is passing on investment advice. In this way, my critique runs right up to the point where Hutchinson asks the perennial question of what exactly to buy. I mean, I really have no idea whether the stock picks suggested are worth much at all, but I can tell you one thing. If they are, it won't be because of the underlying healthy fundamentals of Germany's macroeconomic edifice.

For starters, it does not appear as if the recent stream of data support the underlying optimism on Germany. Sure, we had the ZEW which did indeed post a multi month high, but faced with the general data picture and the outlook. Clearly, Q2 will be better than Q1 across the board and not only in Germany but the central point is the level of stabilisation we will land at. For a reasonable look at the current état du jour in Germany's economy, this piece by Edward is much closer to the point I think.

However, and since I am the one fisking I would be wrong not to deal with Hutchinson's argument specifically.

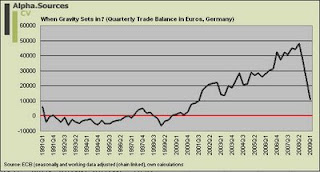

If we start from the bottom, Hutchinson mentions the export orientation of Germany as a virtue in the context of the current crisis as well as he notes how Germany did not participate in the froth and excess through a highly leveraged financial sector. Evidently, these two arguments are grossly simplifying the situation if not outright wrong. First off, Germany is not export oriented, Germany is export dependent and there is a huge difference between the two. In the context of the latter it basically means the Germany needs the extra boost from exports (and foreign asset income) in order to get the growth it so badly needs and it also means that in a crisis when the initial fault line runs across all major external deficit nations Germany suffers immensely. And why is this then?

As readers of Alpha.Source know only too well Germany is dependent on exports because of its demographic profile and because when external demand falters there is no "second leg" to take over and thus growth crumbles as it has. In terms of the underlying point that Germany would stand ready in the event of a sudden pickup in global activity I have to agree in some sense (otherwise my own argument is not consistent). There are however a couple of important qualifiers. First of all, the regions with which Germany in most recent years has exploited the most for its exports (the CEE) are seriously faltering and secondly; the margins in terms of export dependency and the need to run an external surplus achieve growth is getting thinner by the month.

On the point about the financial sector, I really do not know what to say. Recently the ECB published its financial stability report which estimates that Eurozone banks are likely to be forced into further writedowns at an amount equivalent to $283bn. Now, even if you account for the fact that most of these writedowns are pencilled in to occur in Southern Europe this will surely affect Germany too. After all, Germany needs someone to exports to for the underlying argument to hold.

Then there is the modest fiscal stance by the German government and the alleged discipline from the same entity. I am not sure what is really going on here. Perhaps, Mr. Hutchinson is really buying the fairytale German finance minister Peer Steinbrueck tried to sell markets recently when he assured us that the biggest worry he had was that other Eurozone economies would loose the benign conditions raining in Germany when it comes to sovereign debt and thus the fiscal situation. It is true that Germany has entered this crisis on a relatively better footing than most, but this conclusion only holds in an extremely short term prospective. In the long run and given the structural drivers, the outlook on the fiscal situation in Germany looks decidedly difficult. The main point is that Germany is the second oldest country on earth and we have now entered a state in which Germany's particular growth strategy doesn't work. This means next to little growth which is not exactly accommodative to public finances in a country such as Germany.

Basically, the point is quite simply the following. Governments all over world are currently ramping up borrowing extensively to counter the crisis and by 2014 the gross debt/gdp ratio in Germany is expected to reach 91.4%. As a comparison the corresponding figure in the US is projected to be 106.7%. [1] Now, you might say that since Germany started at some 66% and the US at some 63% (in 2008) Germany takes the high road relative to the US. Well you might say this, but you would be wrong. I am not saying that the US situation is not problematic, but the German situation (and in extreme case Japan's) is more than problematic, it is outright unsustainable given the future trajectory of demographic developments.

Finally, there is the point on an excellent workforce and manufacturing industry. Certainly in a global context, Germany is one of the most modern economies but it is very difficult for me to see where big macroeconomic story is here. German manufacturing is largely dependent on exports to achieve growth and as for that workforce; well, not only is shrinking but it is also ageing so once again, I don't see the impetus for the big fanfare here.

The fact of the matter is that the German consumer is ageing and while there is certainly not anything inherent better about the age group "20-40" than the age group "40-60" they behave differently. Moreover, the fact that the latter steadily increases as a proportion of overall income earners, the economy's consumption profile changes and in the context of Germany where you also now have a substantial and rapidly growing proportion of the population in the +60 region it will also exert an important effect on the "quality" of the German workforce even if, and this I have difficulty arguing against, one the world's best educated.

Getting it Wrong?

Let me once again make clear that in terms of the concrete investment advice forwarded by Mr. Hutchinson, I remain silent. I am sure that money can be made in the context of the German equity market and indeed I would argue that for the adept stock picker or, if you will, alpha trader there is always a potential for making money. You could even say, that in the event that we stand before a "VL" shaped recovery Germany may shine, but it is important to point out that this shine is going to temporary, at best.

Consequently, my main beef here is with the underlying macroeconomic analysis of Germany which seems to be me to be very superficial if not outright misplaced. Germany's export orientation (dependence) is not a virtue in the current environment, and Germany's fiscal position, while certainly better at the offset, is not in any ways solid, stable or anything of the like. As I have argued recently, the key here is what happens when investors wake up to the fact that the underlying weaknesses in the Eurozone stretches all the way into that alleged anchor and rock in the form of Germany herself?

Ultimately, I may be harboring a fool's hope here, like Niall Ferguson, that I too will have the opportunity to look at a king and live to tell about it. I would let my readers and others in general to make that judgement. However, I still believe that when it comes to the macroeconomic fundamentals of Germany, Mr. Hutchinson gets it wrong; nay ... he gets it wrong, Big time!

---

[1]: These numbers come from the Economist (via Financial Armageddon).