Review and Preview on Japan

I realize that I am moving in a bit late with this but the data I use to input in my analysis only recently came out for December 2007. More generally, this post is going to be quite big since I have a lot of things I want to get off my chest this time around. I have two main areas of focus I want to cover.

- Firstly I want to finalise my analysis of Japan in 2007 with the December data for consumption expenditures and prices.

- Secondly, I want to continue with a general assessment of two of the main market points in Japan at the moment. The Yen and the BOJ rate policy faced with an incoming slowdown and potential recession.

As for the general situation in Japan I am sure it has not escaped your attention that Japan now seems set to enter a recession. The only question will be the extent and more importantly the length of the slump. In Morgan Stanley's GEF (edition 8th of February) Takehiro Sato points towards industrial production trends as well as US GDP readings and tantamount to the forecast that Japan is heading more meager times ...

The risk of dual recession is mounting. Our US economics team is already calling for capex-induced negative GDP growth in successive quarters (Jan-Mar, Apr-Jun), for a technical minor recession in the first half of the year by definition. We are forecasting that Japan will cling on to a modicum of growth in the Oct-Dec 2007 quarter, boosted by external demand, but there is a possibility that, like the US, that quarter will mark the peak and the economy will retreat in Jan-Mar. Future data for industrial production will tell us if this is the case.

This note will not focus on figures for industrial production or US GDP stats but rather I will initially move in with my traditional focus on the internal demand dynamics in Japan. As ever, the Japan Economy Watch contains the latest cyclical indicators fresh in off the wire in order to bring you up to speed. Here at Alpha.Sources I made a note recently which also sums up the most recent trends and pieces of data. For now, let us turn to the updated charts which usually form the main edifice of my analysis of Japan ...

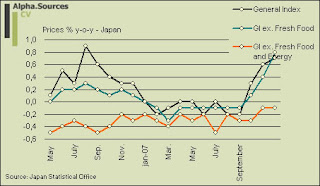

If we begin with prices we see that inflation, at a first glance, seems to have returned to the shores of Japan even to such an extent that I will soon need to adjust the y-axis of my graph (and yes, this is an apology for a sloppy excel graph). Yet, the most important point to take away from this is, as I have been at pains to hammer home before, the disconnect between the inflation indices. Core inflation as measured by inflation ex food and energy prices is still in negative territory whereas the general index is shooting up thanks to headline inflation. This disconnect suggests that the inflation we are seeing in Japan is not driven by demand factors (demand pull) but rather by supply factors (cost push) and thus this does not signal an impending Japanese recovery. Quite the contrary in fact as the spurt of inflation at this particular point in time will only further pinch an already troubled Japanese consumer. Edward also moves in with a much worth while analysis of the inflation issues in Japan. A key point here will be the extent to which future inflation readings will have a bearing on the BOJ's decision to actually move in with a cut in the already low interest rate of 0.5% in order to accommodate a slumping economy. I don't think Fukui will cut rates before his term ends this spring and given the debacle which may arise in the context of finding a new governor it seems that economic fundamentals should not be the only thing to watch in order to make a call. What seems obvious however is that if inflation pressures suddenly show signs on abating the door will be open for a cut.

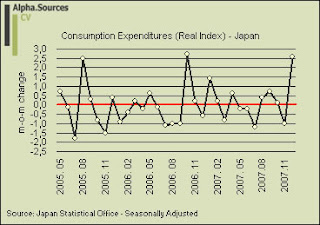

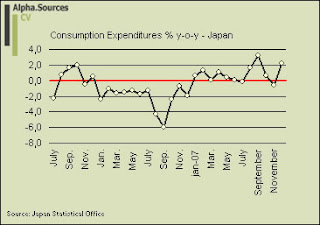

If we turn to the indicators for domestic demand proxied by various measures of consumption expenditures we can also close the book on my forecasts for 2007. As such, I dared to venture that growth in consumption expenditures would not increase by more than 1% on a y-o-y basis. Let us look at what we have.

Let us start by the forecast first. As can be observed the Japanese consumers put in a strong showing in December on a y-o-y basis with a 2.2% increase. I have to say that this figure represents something of a fluke for me since if you look at the underlying indicators such as income, retail sales and department store sales they all clocked in with declines. Ken Worsley also ponders the 2.2% increase and provides a detailed break-down which shows how spending on culture and recreation as well as furniture and household utensils accounted for a substantial part of the increase. I have to agree with Worsley though when it comes to January and beyond where the rise in energy prices, declining income, and a general slumping confidence will be sure to slow spending considerably. As for the forecast, the December reading almost had my forecast shattered or, if you will, assured that I was very close to the mark. Consequently, the mean value of the increase in consumption expenditures was a 0.95% monthly y-o-y growth rate. The two remaining charts are merely there for differentiation. The average value for the m-o-m chart was 0.217% in 2007 and together with the y-o-y figure it shows the momentum and level of growth rates we can expect from Japanese internal demand in a given economic environment. The long term index anchors my analysis in the sense that it supports the general hypothesis that domestic demand is on a structural decline in Japan and that this might very well be due to the demographic profile of Japan, this last point of course being a hypothesis of mine. In terms of forecasts for 2008 I have no trouble extending my forecast of an increase of <1% in domestic demand proxied by consumption expenditures (i.e. a strict consumption definition of internal demand dynamics). This may even seem too easy as 2008 is set to become a somewhat tough year for Japan economically speaking. This was thus it for Japan in 2007 and as is readily clear 2008 promises to bring with it a rather choppy ride for Japan. I will of course continue with my analysis as we move forward. Before I finish I want to make a leap up towards current events (and essentially to the post I linked above) and assess a couple of mounting issues in the context of Japan.

Let us start by the forecast first. As can be observed the Japanese consumers put in a strong showing in December on a y-o-y basis with a 2.2% increase. I have to say that this figure represents something of a fluke for me since if you look at the underlying indicators such as income, retail sales and department store sales they all clocked in with declines. Ken Worsley also ponders the 2.2% increase and provides a detailed break-down which shows how spending on culture and recreation as well as furniture and household utensils accounted for a substantial part of the increase. I have to agree with Worsley though when it comes to January and beyond where the rise in energy prices, declining income, and a general slumping confidence will be sure to slow spending considerably. As for the forecast, the December reading almost had my forecast shattered or, if you will, assured that I was very close to the mark. Consequently, the mean value of the increase in consumption expenditures was a 0.95% monthly y-o-y growth rate. The two remaining charts are merely there for differentiation. The average value for the m-o-m chart was 0.217% in 2007 and together with the y-o-y figure it shows the momentum and level of growth rates we can expect from Japanese internal demand in a given economic environment. The long term index anchors my analysis in the sense that it supports the general hypothesis that domestic demand is on a structural decline in Japan and that this might very well be due to the demographic profile of Japan, this last point of course being a hypothesis of mine. In terms of forecasts for 2008 I have no trouble extending my forecast of an increase of <1% in domestic demand proxied by consumption expenditures (i.e. a strict consumption definition of internal demand dynamics). This may even seem too easy as 2008 is set to become a somewhat tough year for Japan economically speaking. This was thus it for Japan in 2007 and as is readily clear 2008 promises to bring with it a rather choppy ride for Japan. I will of course continue with my analysis as we move forward. Before I finish I want to make a leap up towards current events (and essentially to the post I linked above) and assess a couple of mounting issues in the context of Japan.

Firstly, I think that the Yen demands some attention. Recently, I noted how the Yen was driven by anything but macroeconomic fundamentals. This clearly still seems to be the case. However, the main question is when this will end? At the moment and if you look at the FX price action in the beginning of 2008 almost all Yen crosses have been correlated with the stock market and thus by derivative the general sentiment of risk aversion in the market. This is nothing new in the sense that since the subprime market hit the global economy in the middle of August 2007 the Yen has been the main canary in the coalmine when it comes to the risk sentiment in the market. Yet, the Yen is not only driven by cyclical factors. As such, the decline in home bias of Japanese investors as well as the general yield disadvantage of Japan suggests that all those talks about an undervalued Yen aren't clued in to what is really going on in the sense that what is really the fair Yen value at this point? We need to think about the fact that the whole global economy seems to be undergoing the initial phases of a much more structural correction (recoupling) and in this context it is difficult to see how the Yen can stand its ground. It might not happen today or tomorrow but I have difficulties seeing how the risk aversion dynamic can hold the ground for the more wider and structural trend. Turning to more immediate drivers of the Yen the potential that Japan would intervene in currency markets to cushion the Yen's depreciation has reared its head with regular intervals. Back in early November I asked the question putting the limit at 105 for the USD/YEN which. Various other estimates have been around. Morgan Stanley's Stephen Jen puts it at 100 which is just the same as Macro Man. Recently, currency strategist at Dailyfx Boris Schlossberg kept the speculations alive suggesting, as me, that 105 just might be the threshold for Japan. Currently the Yen is hovering in the region of 106-107 and in this light Boris' conclusion seems to be a sound one, if a bit noncommittal, to take with you in the trenches of FX trading.

While there is certainly no guarantee that the BOJ will intervene at the 105-100 area, economic factors and positioning data suggest that Governor Fukui and company may indeed opt for that solution. Given that possibility the above mentioned strategies should hopefully minimize risk and optimize return for both momentum and carry traders. At the very least traders should pay particular attention to the price action if USDJPY slides down to the 105 level in the near future.

From a macroeconomic point of view this makes sense. Japan is largely dependant on exports to fuel growth as well as need to remember that an appreciating currency is deflationary and Japan has not escaped those fangs just yet. As for the Yen all evidence seems to point towards a continuation of current trends for the immediate future with the Yen acting as a global parameter of risk and investors' risk aversion. In this light, the risk of intervention needs to be weighed in as a potential market mover as we move forward.

The second topic I want to cover has already been mentioned above and essentially also cuts across the whole discussion on the Yen. In short, what will we see from the BOJ? Perhaps the most important thing to note here is that before we get to the discussion of what exactly the policy rate will be as we move forward into 2008 the BOJ will need a new governor. As I noted in my long end-of-2007 note this may well turn out to be quite a messy affair. Whether the shift of guards at the BOJ will turn into the political gridlock many observers have indicated is difficult to see from my desk here in Europe. However, there are some clear risks. As I have argued before a situation of political stalemate in which the Democratic Party of Japan (DPJ) will use their majority in the upper house to stall the nomination of a new governor will, all things equal, bring the MOF closer to monetary policy making. Basic logic would, in such a situation, call for a freeze of the nominal interest rate until the new BOJ leadership is set to assume their seats. However, if this current slowdown turns for the worse it may provoke measures which at this point in time might seem unrealistic. One risk is thus that Japan re-enters ZIRP over the course of 2008 and that this happens sooner rather than later. Before this materializes however, I am quite happy moving in behind the Morgan Stanley team in forecasting a cut in the main refi rate for Q2 2008.

In Conclusion

A lot of ground has already been covered in this piece and as such I think it is time to move in with some summarising remarks. I had two main objectives in this note. Firstly, I finalised my monthly analysis of consumption expenditures (domestic demand) and prices for 2007. Even though 2007 most likely will go down as a rather strong year in relative terms the failure of the overall consumption expenditure gauge to break the 1% threshold YoY tentatively suggests that domestic demand cannot become a driver of growth in Japan in any given sense. This point was underpinned by the monthly and long terms indicators of consumption. In connection to prices, we observed how inflation seems to be coming back to Japan. Yet, if we strip out energy and food Japan is still stuck in deflation and even though the core-of-core index might also nudge up towards positive territory the transmission mechanism from headline inflation to core inflation does not suggest that the inflation pressures we are seeing are driven by buoyant domestic demand. This does not warrant complacency against inflation but tells a story which needs to be told I feel if you really want to understand what is going on in Japan.

I also had a brief look at the Yen and more specifically the driver of the currency. I concluded that while risk sentiment seems to be the main trend explaining the current movements more general structural forces should not be neglected. The key issue here is timing and thus the dynamic relationship between the immediate environment and the more long term structural trends. Moreover, I also reviewed the latest speculation that we will observe intervention in the FX market by MOF and the BOJ. At this point, we have no clear indication that this will occur but I think the possbility should be entertained that the MOF will dip its toe at some point. In terms of the the BOJ and a subsequent call on the rate policy in Japan I moved in behind Morgan Stanley noting that Q2 2008 will see a cut to 0.25%. Another factor which I discussed was the extent to which the departure of governor Fukui will result in a policy gridlock. The risk is definitely there I would argue and it is a possibility which should be taken into account. I think that such a gridlock would (and should) result in a an effective standstill of rate movements but if the slump turns for the worse new dynamics may come into play where the MOF moves in to 'politically' steer down interest rates. Whether 2008 will see ZIRP is still an open question I think. I believe the probability is fairly high not least because I think that the recession we are now seeing on the horizon may very well be more severe than many expect. The main question however is not centered on the slowdown in Japan per se. This is the nature of economic cycles in the sense that they go up and down; yet, what remains the most compelling question in Japan's case is just how far and how long it will be this time.