Soft or Hard Landing in Lithuania?

The fact that economic conditions in Eastern Europe are deteriorating is hardly news at this point. The only question which remains to be answered is the extent to which this will be a hard landing or perhaps more specifically which countries will fair better than others? It is fairly easy to get bogged down into details when it comes to Eastern Europe, something which the Eastern European Economy Watch (run by Edward and me) is a testament to. So, in this entry I will continue my review of Lithuania which, apart from my general notes on Eastern Europe, has constituted my anchor when it comes to understanding the details of the Eastern European situation or perhaps more aptly the situation in the Baltics in particular. If you want background on this you should follow the two links above which can lead you to almost everything Edward and I have written on the topic. However, and in terms of more official contributions to the issue the IMF as well as the World Bank have both made some fine reviews of the issues at hand.

As I noted above this entry will deal exclusively with Lithuania and thus by derivative the Baltics although I think that many of the issues can be extended to the region writ large. A couple of days ago Edward fired a shot across the bow in the context of the Baltics where he asked whether in fact Estonia was heading for a hard landing? The evidence seems mounting that this might be the case and after having looked at Lithuania I find little reason to disagree with him in a general context. And we haven't even noted Latvia here where arguably the most dramatic degree of excessive capital inflows, growth rates, credit exuberance, and inflation have occurred. My analysis on Lithuania will take a close look at the following factors which cuts across the gamut of issues we need to factor in:

- General growth rates - To show the general momentum and when/where it might be turning.

- Prices - This is a natural but increasingly lingering effect of the sizzling growth rates we have seen recently. Basically, we need to think about capacity to grow here without stoking inflation and with the expectations levied on Lithuania (alongside the rest of the region) relative to the underlying capacity (i.e. the labour market conditions mentioned below) we are basically witnessing a huge mismatch which might unwind very rapidly with detrimental consequences to the economy and society as a whole.

- The labour market - This is a very important aspect and essentially cuts into the point that Lithuania like virtually all other countries in Eastern Europe have moved through the demographic transition too fast and too brutish essentially suffering a severe overshot where fertility has declined (throughout the 1990s and into the 21th century) to alarmingly low levels. Coupled with a steady net outflow of migration this is basically hollowing out the human capital foundation of the economy at a speed which not even Edward and I had anticipated and thus the capacity to grow sustainably as well as to enjoy that much allured process of convergence/catch-up growth.

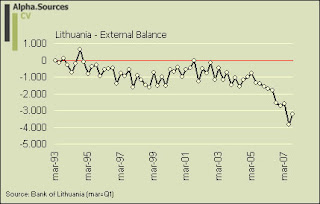

- External balance - The Baltics have very large current account deficits at the same time as they are running currency pegs to the Euro through currency boards. This is not necessarily a recipe for disaster but the extent of the imbalances is mounting and if expectations at some point reverse as to the sturdiness of these pegs the situation could get out of hand. As I will show the condition of the situation rests upon the ability to sustain inflows of credits to consumers (and of course FDI) and given a global credit crunch as well as an unsustainable economic environment it appears that we are moving closer to a situation where the current development cannot be sustained. In general, I think it is reasonable to assume that in a traditional currency crisis framework the currency boards would be pretty helpless in defending the domestic currencies for an extended run. Of course this then gets us into the point about the households' balance sheets and what it will mean if the pegs run loose.

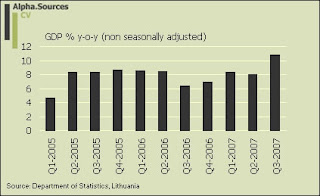

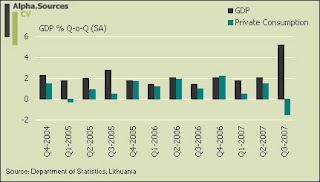

As we can confirm from the graphs above Lithuania continued to thunder along in Q3 even though this constitutes somewhat of a backward looking focus at this point in time. What should be noted however is that while quarterly GDP rose a seasonally adjusted 5.4% private consumption actually declined. This does not fit the growth path by which Lithuania and the Baltics have grown the past years and may signal that something is changing. Especially, I will be watching private consumption since we see a slowdown from here on it will be very difficult to sustain the inflows needed to finance the current external balance and obviously also the headline growth in GDP. In this light the Q3 figures come off as a bit of a fluke really but coupled with a contraction in the external deficit (i.e. as in Estonia) it may be the first signal that things are about to change for the worse in the sense that whatever these countries are ready or not the imbalances are now set to unwind. In this respect the Q4 figures will be most interesting since they will indicate the direction and even more important the speed by which this is moving.

As we can confirm from the graphs above Lithuania continued to thunder along in Q3 even though this constitutes somewhat of a backward looking focus at this point in time. What should be noted however is that while quarterly GDP rose a seasonally adjusted 5.4% private consumption actually declined. This does not fit the growth path by which Lithuania and the Baltics have grown the past years and may signal that something is changing. Especially, I will be watching private consumption since we see a slowdown from here on it will be very difficult to sustain the inflows needed to finance the current external balance and obviously also the headline growth in GDP. In this light the Q3 figures come off as a bit of a fluke really but coupled with a contraction in the external deficit (i.e. as in Estonia) it may be the first signal that things are about to change for the worse in the sense that whatever these countries are ready or not the imbalances are now set to unwind. In this respect the Q4 figures will be most interesting since they will indicate the direction and even more important the speed by which this is moving.Having looked briefly at top line GDP figures I turn now to the more nitty-gritty parts of the analysis. In this way, it would perhaps be a good idea to have a close look at the evolution in prices since the very high rate of inflation has been one of the main detrimental effect of current growth spurt and one which has eroded the external competitiveness. The main reason for this is the well known relationship between productivity growth and growth in wages and how the latter by far has outpaced the former in Lithuania and the Baltics. More so, prices become important since if we were to identify a break-point in topline GDP growth inflation should follow down. This is likely to happen sooner or later of course but the flip side of this is the point that with their currencies pegged to the Euro the only way Lithuania can ultimately correct once growth stalls is through price deflation. In fact, you could argue that if the imbalances begin to unwind disorderly it may be difficult to stop this from happening which is why of course we need to make sure we don't get to that.

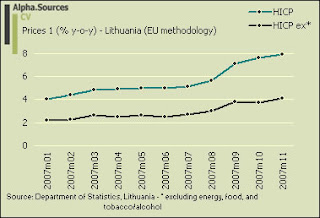

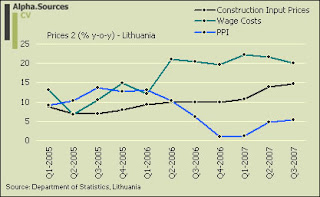

The first graph is particularly interesting since it takes us into the real world so to speak as it shows us the evolution in monthly prices which confirm that the increase in price growth seems set to linger in Q4. I have chosen to add both the main core index and the core index stripped of headline inflation in light of the order du jour in current economic and financial debates. So, pick your weapon of choice. Either way, the main index running at 8% as we exit 2007 demonstrate the generally elevated pace of things. If we move into the more finer grains of the price developments we see that wage costs increases are still in the >20% ballpark and that construction input prices are also running high up the ladder which is rather significant since the construction sector has been one of the main sectors driving the expansion. As for the PPI I am happy that we are seeing an increase since I have had some issues discerning why it was that low since it marked on of the peculiar ways in which Lithuania differed from its Baltic brethren. As a conclusion, nothing new from the front it seems when it comes to inflation and we will now have to see if growth slows down just what the transmission mechanism will be. However, as I have noted we could run into deflation at some point and really this would only be a matter of how long the pegs were able to hold and thus the 'willingness' to correct through bending the stick too much into one direction (deflation, massive fiscal tightening etc) relative to the other (letting the Litas go).

The first graph is particularly interesting since it takes us into the real world so to speak as it shows us the evolution in monthly prices which confirm that the increase in price growth seems set to linger in Q4. I have chosen to add both the main core index and the core index stripped of headline inflation in light of the order du jour in current economic and financial debates. So, pick your weapon of choice. Either way, the main index running at 8% as we exit 2007 demonstrate the generally elevated pace of things. If we move into the more finer grains of the price developments we see that wage costs increases are still in the >20% ballpark and that construction input prices are also running high up the ladder which is rather significant since the construction sector has been one of the main sectors driving the expansion. As for the PPI I am happy that we are seeing an increase since I have had some issues discerning why it was that low since it marked on of the peculiar ways in which Lithuania differed from its Baltic brethren. As a conclusion, nothing new from the front it seems when it comes to inflation and we will now have to see if growth slows down just what the transmission mechanism will be. However, as I have noted we could run into deflation at some point and really this would only be a matter of how long the pegs were able to hold and thus the 'willingness' to correct through bending the stick too much into one direction (deflation, massive fiscal tightening etc) relative to the other (letting the Litas go).If inflation is one of the chief effects of the growth momentum we have observed lately what is the course then? Clearly, a high inflation rate is to be expected in emerging markets as higher relative growth rates also lead to higher relative inflation rates following the principles of growth convergence. But why have inflation rates been as high as we have seen in Lithuania? Well, in order to understand this we need to use some basic macroeconomic intuition as I also explain in my introduction above. Essentially, we need to look at the labour market and thus always remember the two stylised facts. 1) the trend of net outward migration in the most productive labor cohorts and 2) the collapse in fertility throughout the 1990s.

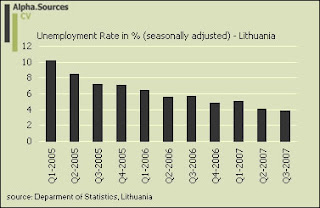

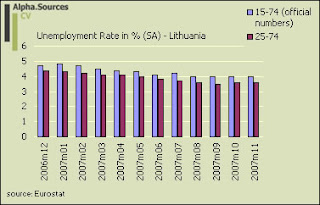

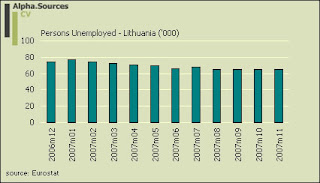

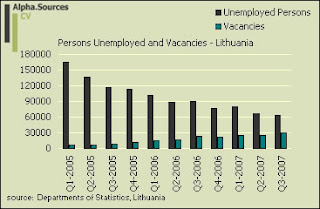

You don't need to be a macroeconomic literate to see that the general condition on the labour market is one of some tightness. Depending on the measure you look at and whether it be quarterly or monthly the unemployment rate is roughly running at 4% as we exit 2007 down from about 5% in the beginning of 2007. In numerical terms this corresponds roughly to a decline from 80.000 to 60.000 depending on the figures you look at. Now, this might not mean much but we need to consider a few things. The first thing is of course the relative tightness of the labour market from a general empirical perspective where we know that once we venture into the 3-4% range we get into serious bottleneck and mismatch issues. The job vacancy rate is a good proxy here and as can be seen from the last graph we are soon running into one of those 'does not compute' issues since with 60.000 persons unemployed and 30.000 vacancies it we are looking at a vacancy ratio of about 2 which is very tight. Another thing to take into a account is the net migration rate. Since 2001, Lithuania has 'lost' around 5000-6000 people each year and if we apply this average figure for 2007 we can easily see how the string is getting tighter by the day.

You don't need to be a macroeconomic literate to see that the general condition on the labour market is one of some tightness. Depending on the measure you look at and whether it be quarterly or monthly the unemployment rate is roughly running at 4% as we exit 2007 down from about 5% in the beginning of 2007. In numerical terms this corresponds roughly to a decline from 80.000 to 60.000 depending on the figures you look at. Now, this might not mean much but we need to consider a few things. The first thing is of course the relative tightness of the labour market from a general empirical perspective where we know that once we venture into the 3-4% range we get into serious bottleneck and mismatch issues. The job vacancy rate is a good proxy here and as can be seen from the last graph we are soon running into one of those 'does not compute' issues since with 60.000 persons unemployed and 30.000 vacancies it we are looking at a vacancy ratio of about 2 which is very tight. Another thing to take into a account is the net migration rate. Since 2001, Lithuania has 'lost' around 5000-6000 people each year and if we apply this average figure for 2007 we can easily see how the string is getting tighter by the day.The labour market issues are important for two primary reasons. The first is the contribution of the tight labour market to inflation and wage costs and essentially how productivity increases stand no chance in following the increases in wages. The second point however is the risk that as growth stalls the unemployment rate will rise again. Now, this of course somewhat an argument non-sequitur in the sense that it is a foregone conclusion. An economy cannot 'run out' of labour but what happens to migration flows then? This is big issue for me and if a severe slump intensifies the outward migration of qualified labour (i.e. this is the labour most likely to move first) the human capital foundation of the country will simply get eroded. So, take note! This is something to watch and really I would like to see not only a endogenously generated response within Lithuania and the Baltics but also a EU wide response to this issue since it is a most pressing one and not merely one of how the EU15 can use Eu10 as a labour repository.

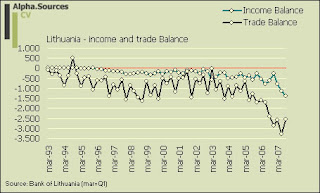

The final section of my note takes us to the dark vaults of balance of payment analysis and essentially constitutes an expansion relative to my previous focus on Lithuania in past notes. For an appetizer for what comes next my recent note on Poland's external position might be handy. Let us look at the graphs and then move our way through the argument.

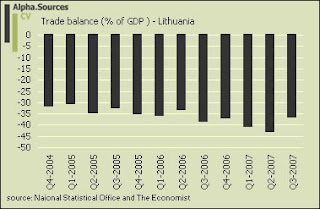

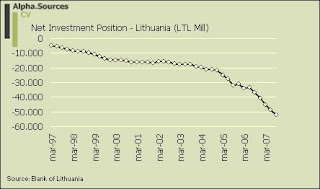

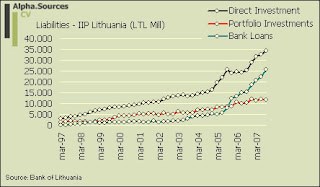

The graphs are divided into two topics. The three first shows the evolution of the overall current account balance in various measures whereas the last two plots information on the net investment position (NIIP) which is a stock measure of the difference between a country's external financial assets and liabilities. If the NIIP is in the red as is the case here it means that external liabilities outweigh external assets.

The graphs are divided into two topics. The three first shows the evolution of the overall current account balance in various measures whereas the last two plots information on the net investment position (NIIP) which is a stock measure of the difference between a country's external financial assets and liabilities. If the NIIP is in the red as is the case here it means that external liabilities outweigh external assets. If we look at the three first graphs we confirm the general idea that Lithuania is running a large external deficit. Especially the q-o-q measure of the trade balance expressed as percentage of GDP sums up the general picture I think with a trade deficit amounting to >35% of GDP. Another more cyclical thing note is the contraction in the external deficit in Q3 which coincides with the drop in consumption expenditure in Q3. This is not coincidental I think and as I say above we now need to watch closely what happens in Q4 since if the current trajectory continues Lithuania may run into trouble sustaining the inflows needed to cover its external deficit in the sense that we might just be moving into a situation where the trend is breaking with respect to growth in private consumption. So what is this all about then? This is where we need to the NIIP then. As two points should be noted from the graphs above apart from the obvious point that the NIIP is negative by some margin. The first is the composition of external liabilities where especially bank loans need to emphasised. What we basically have here is then the formal evidence for all the stories we have heard about how foreign banks have been entering the Eastern European/Baltic markets through provisions of consumer credit, loans and mortgages often denominated in Euros (in the Baltics) and Swiss Francs in Hungary and Romania. We see clearly then how bank loans have contributed heavily to evolution of the NIIP and if we sideline this with the evolution of private consumption not to mention the whole global credit crunch debacle it is not difficult to see how this link of the chain might be a bit corrosive as we move forward even if it is not yet certain that it will break. The second point is that we see evidence in Lithuania of the same inter temporal correlation between the inflow of direct investment and the income balance as in Poland. Basically, the inflow of direct investment means that foreigners will earn more on their assets in Lithuania than Lithuanians earn on assets abroad. This is not necessarily alarming in itself and quite natural if you factor in the economic dynamics. But in Lithuania's situation with its monetary policy tied to a currency board and with the current state of the external position a structurally deteriorating income balance will make it even harder to swing the external deficit into a comfortable territory.

Conclusion

So, is it crunch time in Lithuania? This is difficult to say but what is certain is a that significant slowdown is now coming. Whether it will be hard is another question. Essentially, a hard landing would entail a sharp stop in the inflows as foreign banks' subsidiaries retreat to their native territories. This could then unravel the whole edifice of a pegged currency regime and the households' un-hedged cross-currency liabilities. The real question is then whether the banks who represent the main life line for an orderly slowdown will stay pat and follow the growth down or whether they will back up their bags and cut their losses. The outlook on this will most likely hinge on two things. The general nature of the slowdown in Lithuania and by proxy the individual countries' relative slowdown in growth and secondly the risk that events in one country will spread to another. As for the first one it is likely to be rather abrupt as we see now that both consumer confidence and consumer spending indices are dropping sharply in almost every country. However, what might end up tipping the boat will be the likelihood that events in one country can spread to another. Here I am particularly looking for the risk that events in Hungary or Romania will act as the well known canary in the coalmine.

It remains to be seen at this point. Q4 will be important for Lithuania I think as well as will the general and ongoing nature of the global financial market turmoil. If things turn to the worse with respect to financial markets in general and if that famous spread between the LIBOR and the nominal rate widens again it could incite some of the banks most exposed in Eastern Europe to cut their losses while they can and if one goes they all go I think. So, this note does not emphasise panic but rather calm oversight. Yet, the risk of a hard landing is not decreasing as we move forward I think which is perhaps the real message to take away here more than an actual call. In this light, I would extent my voice to the fine people at the ECB and EU in general to keep a weary eye on events here since if things turn for the worse timely action will be needed and not a stick followed by some pointless rant about how Euro membership is now postponed for another decade.