Small Update on Japan

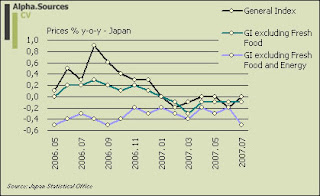

Edward already dishes up the recent relevant data points from Japan over at Japan Economy Watch which all point towards an entrenchment of Japanese economic fundamentals signifying continuous deflation as well as stubbornly depressed domestic demand. This will consequently be a brief data presentation which basically extends some of the data sheets featured in my recent in-depth note on Japan. Let us begin with prices which clearly indicates that Japan remains bogged down in deflation. The general index excluding fresh food stood firm at a negative rate of -0.1% as in the previous four months but notice especially the core-of-core rate which slumped to a rate of -0.5%.

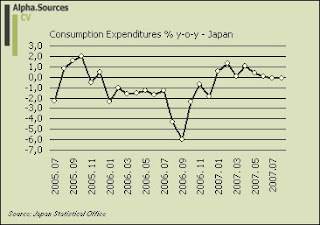

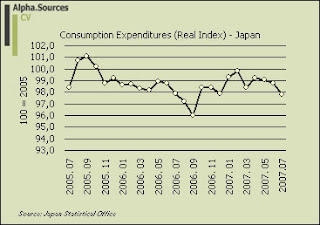

Finally, we have two measures of private domestic consumption which sadly shows how internal demand in Japan is set on a relative downward path in H1 07. We could of course well see a mild recovery in H2 but I don't think this will change the underlying trend.

Finally, we have two measures of private domestic consumption which sadly shows how internal demand in Japan is set on a relative downward path in H1 07. We could of course well see a mild recovery in H2 but I don't think this will change the underlying trend.

These charts clearly demonstrates the difficulties with which Japan is having producing the much wanted and hailed 'sustainable' recovery. In fact, if we scrutinize the data as they have been presented recently we can easily see how Japan is not exactly set on a strong and solidified path of recovery in the sense that it will foster a strong sustained pick-up in domestic demand, normalization of Japanese interest rates etc. This does not of course mean that we cannot experience a positive pick-up in the incoming data but we need to remember the underlying trend. In this light I want to make two subtle predictions for the remainder of 2007. 1) Japan will not escape deflation in its core-of-core index and 2) Japanese domestic consumption while maybe osciliating will not nudge above a y-o-y growth rate of 1%.

These charts clearly demonstrates the difficulties with which Japan is having producing the much wanted and hailed 'sustainable' recovery. In fact, if we scrutinize the data as they have been presented recently we can easily see how Japan is not exactly set on a strong and solidified path of recovery in the sense that it will foster a strong sustained pick-up in domestic demand, normalization of Japanese interest rates etc. This does not of course mean that we cannot experience a positive pick-up in the incoming data but we need to remember the underlying trend. In this light I want to make two subtle predictions for the remainder of 2007. 1) Japan will not escape deflation in its core-of-core index and 2) Japanese domestic consumption while maybe osciliating will not nudge above a y-o-y growth rate of 1%.

Sorry, if I remain somewhat in 'Japan-mode' this morning but I do think that the following two morning notes from Bloomberg pretty much nails it in relation to the current economic sentiment in Japan. First off, we have the report that wages fell for an eigth consecutive month clipping in their steepest fall in three years. Clearly, this is now becoming part of a well-known and essentially lingering trend in Japan and to be fair to the analyst department at Bloomberg the main theoretical current indeed seems to have trickled down proxied by the following quote taken from Yoshiki Shinke who is chief economist at Dai-Ichi Life Research Institute in Tokyo ...

One reason average wages have slipped since December is the replacement of retiring baby boomers with younger, cheaper employees. Another is the increased hiring of part-time workers, whose pay is on average less half that of full-timers, Shinke said.

Average pay fell about 10 percent between 1997 and 2005. One in three Japanese workers is a part-timer today, compared with one in five a decade ago.

Apart from the obvious strain on aggregate wages which arise from the compositional shift in the labour force as baby-boomers retire I would also especially emphasize the trend in part-time employment since this seems more and more like an inevitable result of a rapidly ageing workforce. At least this seems to be case in Japan although of course it is difficult to extrapolate to other countries at this point. Moreover, and as a further nail in Japan's coffin Q2 estimates of corporate capex was revised down today and with quarterly seasonally adjusted GDP already running at a measly 0.1% there is not much slack to eat up which consequently suggest that Japan actually contracted in Q2. Clearly, this is all about statistics and measurement methods but it could hardly have come at a worse time for Japan in a climate of uncertainty of the state of global financial markets, Bernanke's missing put (will it ever come :)), and thus the evolution of the US economy in the latter part of 2007.