Q2 GDP Data from The Eurozone

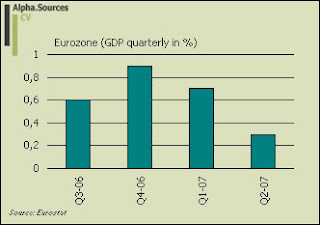

In keeping with tradition and also because I have only recently returned from holiday I am coming in on the heels of Sebastian Dullien from Eurozone Watch and Morgan Stanley's Elga Bartsch in my assessment of the big events in the Eurozone economy. In this case the Q2 GDP figures are up for scrutiny and relative to Sebastian's and Elga's fine reviews I provide some graphical displays too. As I have already noted briefly in my previous note the numbers came out largely as I had expected in the sense that we are now looking at a marked slowdown. For a complete overview of the aggregate Eurozone GDP performance over the last four quarters the graph below plots the relevant data. As we can see the Eurozone has steadily slowed from a stellar performance in Q4 2006 to a much more meager performance in Q2 2007 as with a quarterly growth rate at only 0.3% on the back of 0.6/0.7% (depending on statistical measurements) in Q1 2007. In this light and even though I had indeed expected an aggregate slowdown 0.3% seems a bit stark and on that note I do expect the quarterly figures for Q3 2007 to improve but only slightly. Another possibility would be for the current GDP estimate to be adjusted upwards at a later stage. In any case a large part of the hefty decline in Q2 GDP comes from the negative contribution from industrial production which we might expect to pick up slightly in the current quarter as noted by Sebastian (linked above) However, what does seem to be certain is that the consensus forecasts for annual GDP growth seems to stand before a significant downward correction in line with my overall and relative bearish outlook on the Eurozone based solidly on an analysis of real economic fundamentals. Turning to the individual countries an an assessment of the big four in the Eurozone especially poor Italy was a drag on Eurozone growth and it is looking more and more as if we are moving into some very uneasy territory towards the end of 2007 with Italy's large public debt and over the year budget deficit. This is especially the case as the debacle in the credit markets seem set to continue which is sure to put considerable downside risk to real economic fundamentals. In this light the recent comments from Italy's Finance Minister Tommaso Padoa-Schioppa that Italy would not raise capital through government debt to put a floor under what seems to a pretty hefty slowdown. Of course, the Finance Minister was explicitly referring to the potential adverse effects from the mess in credit markets but at this point this must be considered proxy for a much wider ranging issue and just what will happen to Italy's sovereign debt rating if growth does not pick up. Returning to the actual data in the membership countries we can see that all the big countries posted a somewhat decline in Q2.

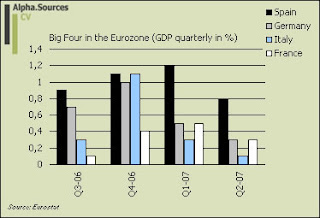

As we can see the Eurozone has steadily slowed from a stellar performance in Q4 2006 to a much more meager performance in Q2 2007 as with a quarterly growth rate at only 0.3% on the back of 0.6/0.7% (depending on statistical measurements) in Q1 2007. In this light and even though I had indeed expected an aggregate slowdown 0.3% seems a bit stark and on that note I do expect the quarterly figures for Q3 2007 to improve but only slightly. Another possibility would be for the current GDP estimate to be adjusted upwards at a later stage. In any case a large part of the hefty decline in Q2 GDP comes from the negative contribution from industrial production which we might expect to pick up slightly in the current quarter as noted by Sebastian (linked above) However, what does seem to be certain is that the consensus forecasts for annual GDP growth seems to stand before a significant downward correction in line with my overall and relative bearish outlook on the Eurozone based solidly on an analysis of real economic fundamentals. Turning to the individual countries an an assessment of the big four in the Eurozone especially poor Italy was a drag on Eurozone growth and it is looking more and more as if we are moving into some very uneasy territory towards the end of 2007 with Italy's large public debt and over the year budget deficit. This is especially the case as the debacle in the credit markets seem set to continue which is sure to put considerable downside risk to real economic fundamentals. In this light the recent comments from Italy's Finance Minister Tommaso Padoa-Schioppa that Italy would not raise capital through government debt to put a floor under what seems to a pretty hefty slowdown. Of course, the Finance Minister was explicitly referring to the potential adverse effects from the mess in credit markets but at this point this must be considered proxy for a much wider ranging issue and just what will happen to Italy's sovereign debt rating if growth does not pick up. Returning to the actual data in the membership countries we can see that all the big countries posted a somewhat decline in Q2. In Spain growth slowed to below 1% quarterly growth which is still though considerably above the other big member countries. Apart from Italy's poor performance also Germany posted a disappointing 0.3% GDP growth rate and more worryingly as also noted by Sebastian Dullien (linked above) especially German domestic demand seems stubbornly reluctant to really take off. This does not come as unexpected news I think and as I have argued several times we need to look at the structural characteristics of Germany's ageing population to understand why domestic demand in any sense won't be able to pull forward the economy. More generally in the case of Germany we also need to look at the destination of German exports and especially the destination of the growth of German exports which increasingly is reliant of the CEE economies and Russia. As such and since the CEE economies are perhaps set to become very interesting as we move further into 2007 the growth platform in the Eurozone is becoming shaky indeed. Lastly on Germany we also have the recent ZEW business confidence measure which demonstrates a clear feedback mechanism from the recent turmoil in financial markets. So what we seem to have on our hands here is an already present slowdown which is exacerbated by the wobbles in financial markets.

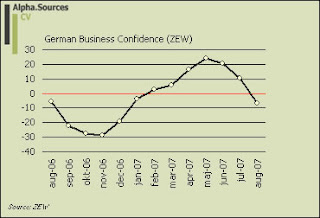

In Spain growth slowed to below 1% quarterly growth which is still though considerably above the other big member countries. Apart from Italy's poor performance also Germany posted a disappointing 0.3% GDP growth rate and more worryingly as also noted by Sebastian Dullien (linked above) especially German domestic demand seems stubbornly reluctant to really take off. This does not come as unexpected news I think and as I have argued several times we need to look at the structural characteristics of Germany's ageing population to understand why domestic demand in any sense won't be able to pull forward the economy. More generally in the case of Germany we also need to look at the destination of German exports and especially the destination of the growth of German exports which increasingly is reliant of the CEE economies and Russia. As such and since the CEE economies are perhaps set to become very interesting as we move further into 2007 the growth platform in the Eurozone is becoming shaky indeed. Lastly on Germany we also have the recent ZEW business confidence measure which demonstrates a clear feedback mechanism from the recent turmoil in financial markets. So what we seem to have on our hands here is an already present slowdown which is exacerbated by the wobbles in financial markets.

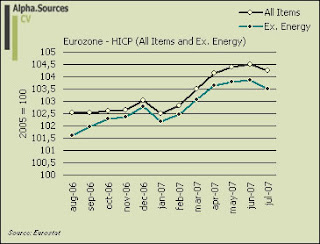

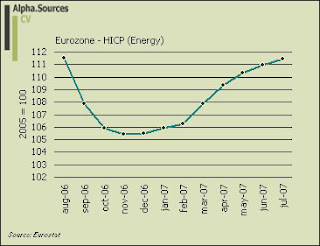

Turning to France we also note a disappointing trend and in fact over the last four quarters it is the worst performers amongst the Eurozone countries. I will however expect France to outperform Italy somewhat over the course of the next quarters. The last thing I want to show are two graphs of recent monthly inflation measures which after all is the ECB's weapon of choice (apart from the M3) in setting interest policy relative to the gauges of real economic fundamentals. As we can see the first half of 2007 have been marked by a significant uptick of inflation which in this case is measured by the HICP index (index 100 = 2005).

Turning to France we also note a disappointing trend and in fact over the last four quarters it is the worst performers amongst the Eurozone countries. I will however expect France to outperform Italy somewhat over the course of the next quarters. The last thing I want to show are two graphs of recent monthly inflation measures which after all is the ECB's weapon of choice (apart from the M3) in setting interest policy relative to the gauges of real economic fundamentals. As we can see the first half of 2007 have been marked by a significant uptick of inflation which in this case is measured by the HICP index (index 100 = 2005).

Note in particular the u-shaped curve for energy prices which suggest that headline inflation pressures are returning after a dip in the latter part of 2006. Expressed in percentages the inflation rate for July was 1.8% down from 1.9% in June as reported by Eurostat. However as the FT also notes the recent monhtly dip masks the fact that core prices held steady which suggests that future inflation is in the pipeline (apart from headline inflation) as we venture through the last part of 2007. As I have also noted before this puts the ECB in a difficult spot note least because the credit market turmoil also loom ever more so in the background. The main issues rests on the ECB's vigilance against inflation which is of course well established relative to the downside risk of a continuation of the deterioration of the economic fundamentals as well as the potential disturbing effects from wobbly financial markets.

Note in particular the u-shaped curve for energy prices which suggest that headline inflation pressures are returning after a dip in the latter part of 2006. Expressed in percentages the inflation rate for July was 1.8% down from 1.9% in June as reported by Eurostat. However as the FT also notes the recent monhtly dip masks the fact that core prices held steady which suggests that future inflation is in the pipeline (apart from headline inflation) as we venture through the last part of 2007. As I have also noted before this puts the ECB in a difficult spot note least because the credit market turmoil also loom ever more so in the background. The main issues rests on the ECB's vigilance against inflation which is of course well established relative to the downside risk of a continuation of the deterioration of the economic fundamentals as well as the potential disturbing effects from wobbly financial markets.

Summary

The second quarter GDP figures from the Eurozone came out largely below the consensus forecast and coupled with the recent and apparently sustained bout of market wobbles the outlook for the Eurozone economy seems to coming in line with the general out of consensus bearish analysis voiced here at Alpha.Sources. At this point the next interesting obviously centers around the probability of a hike by the ECB come September. Given the recent comments coming out of Frankfurt you would expect 4.25% to be a done deal and indeed judged by inflation pressures there seems to be ground for a hike. However, at this point other issues are of course entering the big equation and beyond what seems to be a clear deterioration of economic fundamentals. At this point it is difficult to see what the major central banks will do in the midst of the current financial debacle regarding short term interest rates. A big test will come Thursday when the BOJ decides whether to push forward. I have argued that this is unlikely for other reasons than the current credit/liquidity crunch but it will be interesting to see what the discourse will be. The ECB will be facing a similar issue in so far as how to incorporate the financial market situation into the general assessment. Clearly, the probability of a hike has gone down both with the current GDP figures as well as the financial market situation but I maintain my view that the ECB will take it to 4.25% which will be held for the remainder of 2007. An obvious downside to this call is of course whether the central banks need to step up their role as lenders of last resort as well as perhaps twig short term interest rates in what could only be interpreted as emergency moves. At this point, I think this is unlikely but the risk is clearly there.