Q1 GDP Figures from the Eurozone

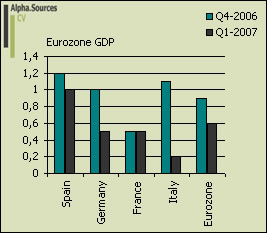

Yep, they are in and not really much new. I had my forecast placed at about 0.5% in my most pessimistic moments nudging up to 0.7% when optimism struck me. The actual number was 0.6% as reported by Eurostat this morning and this figure also goes for EU27 for that matter. Compared to 2006 it is of course somewhat of a slowdown on the back of the impressive 0.9% growth rate q-o-q recorded in Q4 2006. In the figure below I have plotted the transition from Q4 2006 to Q1 2007 in the Eurozone and the four biggest member countries.

As we immediately see all countries but France have seen their growth rate deteriorate which is only as would be expected. This should be seen on back of the continuing hiking process by the ECB, the slowdown in the US (although de-coupling is of course still all the rage), and the VAT hike Germany which is singled as the culprit for many ill things at the moment among those a slowdown in Germany and thus in the rest of Europe. As we dig deeper into sources of growth some notable things stand out. In Germany, retail sales and consumer spending have generally made for pretty grim reading in Q1 2007 but what does that matter when you an export and industrial sector which power along. Of course consumer spending might recover in the quarters to come but I hardly think anything is going to change in Germany where exports remain to be the main engine for growth. Conversely in France consumer spending is what drove the economy to a steady 0.5% GDP growth q-o-q. It needs to said though that exports also contributed to growth as Germany pulled ahead the Eurozone economy through intra-European trade, a point which of course puts two ways as France also represents Germany's biggest export market. Spain remains to be the high roller of the big four in Europe posting a growth rate of 1.0% in Q1 2007 and even more so than in France this rather buyoant growth rate is sparked by domestic demand which again has fuelled a large current account deficit. Finally, we have poor Italy which sees its growth rate slump to a mere 0.2% which is well below the Eurozone average, this slump it has to be said comes on the back of a very strong performance in Q4 2006. A contraction in manufacturing and persistingly weak consumer spending are identified as the main culprits although buyoant intra-european trade has allowed the big Italian companies to raise revenues. Consequently, Fiat raised its topline by a healthy 8.9%.

In Summary

So, is this good or bad, surprising or unsurprising, on the upside or downside? There are many ways to spin this I think and as an entry point into 2007 it is really difficult to say anything conclusive about whether this slowdown will be sustained before we get figures from Q2. One way to look at it is also as the FT reports that Europe for the second consecutive quarter outpaces growth in the US which on a q-o-q grew 0.3% in Q1 2007. Over at Eurozone Watch Sebastian also notes the impressive performance of capex and exports in Germany which seems to have more than compensated for sluggish consumer spending in the first three months of 2007.

The interesting question of course is how this will affect the high lords in Frankfurt in terms of interest rate decisions. Clearly, the slowdown is real but we also need to think of this in relative terms which makes the current momentum in Europe and the Eurozone pretty impressive. The question is of course whether this can continue?