Japan's Savings - Going for Yield

[Update added below: Stephen Jen moves in with a very timely piece relative to the analysis below. In fact, as my regular readers will know I tend to agree with a lot springing from his hands and this is no expection.]

The idea of having a large pool of funds to place on the world's asset markets in order to live off of the derived income seems alluring to most I think. In fact, you could argue that it is precisely this allure and many an economy's pursuit of it which is causing much of the current debacle in the global economic edifice. In Japan's case I am arguing as a part of my ongoing observations that Japan is now dependent on exports. In reality Japan has been dependent on external demand to grow for some time now. More specifically I have argued why we should look at Japan's age structure to find the principal reason as to why Japan has the growth profile it has. The point is simply that when the labouring cohorts of the economy are declining in number with such a pace as we are seeing in Japan domestic production and productivity will have to be channeled towards external demand. I see no coincidence in all this but a quite natural consequence of the fact that domestic capacity in Japan is now declining and will continue to do so for the immediate future. As such, if Japan is ever to keep the ratings agencies at bay and if Japan is ever going to have hope, even a fool's hope, of servicing the pension demands of her citizens it is necessary for the economy to be biased the way it is. Of course, and this I have been pointing out extensively, the problem is that Japan is not the only ageing economy and in fact if we extrapolate the demographic developments a bit we are going to end up with a lot of exporters and no one willing to run a respectable external deficit. This global bias towards one end of the inter temporal spectrum of the current account is a very interesting theoretical theme which I intend on investigating further as I go along. In a recent post I elaborate further on this topic and especially the following rather lengthy quote is important to take away in terms of my main argument.

"This 'crowding' of countries in one end of the inter temporal spectrum of savings/investment and consumption is not coincidental and perhaps most importantly it will result in important global externalities. The drivers of this tendency (to the extent that it exists) need to be found in terms of life cycle dynamics aggregated to population levels. At this point I feel that we are far away from really pinning this one down. However, one part of it is related to three potential hypotheses that I am working with in terms of consumers life cycle pattern. 1) people do not dissave to 0 since they do not know when they will end their existence. 2) Rising life expectancy will induce consumers to save more and longer during their life cycle. 3) Ageing societies are likely to, one way or the other, promote forced savings in order to ease the societal burden of the intergenerational skewness as the dependency ration rises. If we add this together with the decline in home bias currently observed in Japan (the oldest society on earth) we consequently run smack into the externalities I was talking about before. Consequently, if we go back to the point on intergenerational preference for spending we need to understand that ageing economies will indeed attempt to invest their accumulated savings. They have to in order to earn income but they cannot invest it in their domestic economies. Thus we have the externality in the sense that as the world ages we are likely to see a process by which more and more countries will develop a propensity to 'export' in order to sustain growth."

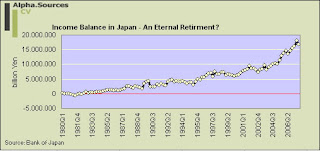

So, what does it mean to be dependant on external demand? Traditionally we think of Japan as being dependent on exports of tangibles but this does not represent the complete picture. To be sure Japan is extremely dependent on exports in the form of a trade surplus but on the margin another factor is important too; the income balance.

Whether the graphs above tell the story of an ageing economy is of course debatable. I clearly think it is and I believe that there are sound theoretical reasons back my thesis. This point notwithstanding we can clearly see how Japanese savers have stepped up their holdings of foreign assets and given the impressive growth of the global economy the income earned has certainly been quite respectable. However, why invest abroad when you can invest at home? Well, I have always answered that question above but two separate headlines in Bloomberg very neatly sums up the situation. First, we learned from Bloomberg reporter Patrick Rial that Japanese companies lost investors a hefty $3.2 billion the fiscal year ending this April and secondly we got the news, referring to the charts above, that Japan was the largest holder of foreign assets in the world. I don't think it takes much of an economist to connect the dots here and if we accept the fact that Japan's deflation problem and its subsequent low interest rate are related to the country's demographic profile it should not be too difficult to see what is going on.

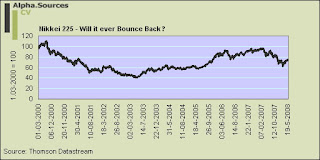

The graphs above will be familiar to many a financial trader as it shows the lingering negative trend in Japan's main stock index. Of course the second index could just as well have been made with 2003 as a starting point in which case we would be observing +100. In this light it will be interesting to see just how far the Nikkei will fall this time around as Japan enters yet another tough patch in terms of economic growth.

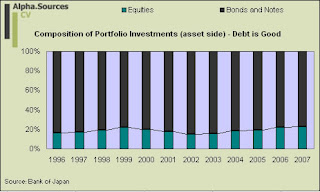

It is thus not so strange that Japanese savings are rather eager to go abroad and why we consequently have observed a very rapid decline of home bias amongst Japanese investors. However, this decline is not so much a story of equities but rather one of debt (0.5% interest rate remember) not least the samurai bonds; a topic which I have addressed on several occasions.

The graph above speaks a clear language I feel and even though the share of equities have nudged upwards recently the majority of Japanese portfolio investments still go into debt. Lead by a suffering Citi Group in the wake of the credit turmoil the sale of yen denominated bonds is thus estimated to have tripled in 2007 from 2006. Part of this was no doubt due to the fact that spreads in Japan offered significantly more calm straits than the credit crunch laden debt markets in Europe and the US but it is also a simple reflection of the fact that Japan has the spare capital. In this way and as a market mechanism Japan's role here is no different from when one of those much debated SWF dares to venture a stake in rebuilding the balance sheet of a tarnished knight from the US financial service sector. In the context of the credit turmoil Reuters also reported how market participants are well satisfied with the state of affairs;

Dealers in the Samurai market say investors remain keen to buy the bonds -- issued in Japan by foreign entities -- because of the higher yields they now offer and because they see little risk of big U.S. banks and investment banks defaulting.

We can always quibble about just how secure those US investment banks are (well, if Bear Stearns is anything to go by I would say very!) but from Japan's point of view and in the grand scheme of things with a debt/GDP ratio of 170% the income earned on these instruments are quite vital. In fact, notional evidence suggests that Japan may well be an asset managers wet dream in terms of securing funding. A Bloomberg piece fresh in off the wire consequently alerts us to the fact that hedge funds are also dotting down Japanese savings for a source of capital. Obviously, these money need to earn a return though and this is where it all gets very complicated since what happens when everybody wants to be Japan? Coupled with a reserves piling up in China and in the petroexporters' vaults hunt for yield and the subsequent low return and/or overheating are structural consequences for the growth path of the global economy.

A Tendency to Watch

I think that the points above represent important tendencies to watch for both theoretical economists and investors alike.

- For academic wonks (such as myself in spe) I think that the idea of the inter temporal current account is important in terms of describing what is going on. More specifically I believe that the tendency of ageing economies to exhibit the same savings/consumption profile in terms of the trade-off between the two is important. If we look at the inter temporality as a spectrum we can say that as the global economy ages economies will tend to crowd in one end of the spectrum and I think that important externalities will arise as a result.

- For investors and asset managers I don't think that the importance need much explanation. However, I do think it is important that investors think about narrating capacity and more importantly excess capacity in terms of demographic age structures. In the context of Japan it means that ageing economies can be a source of capital (hardly news at this point) but it also means that changing demographics in terms of age structure should be incorporated into the asset management framework.

Morgan Stanley's Stephen Jen moves in with a very relevant piece to the post above. Specifically, Jen talks about the prospect of a Japanese SWF/SPF and what this will mean for Japan's home bias and of course the JPY. It is well worth a look especially since my argument is very close to Jen's narrative.

His bottom line ...

While USD/JPY could indeed spike lower in times of extreme risk aversion, I believe that there will be powerful factors preventing USD/JPY from staying below 100 for a sustained period. 110 for USD/JPY makes more sense than 90. The impending reform of the GPIF is one important example of how Japan’s financial home bias could continue to decline, keeping the JPY undervalued. Given the size of the AUM, I urge investors to pay close attention to the GPIF reform that will likely take place in the coming months.