No Adjustment in Sight

On the back of the rather disappointing Q2 GDP from the Eurozone many commentators were expecting the figures to be revised upwards as the drop in investment seemed a bit too stark to be realistic. It is of course always difficult to make de-facto judgements on the statistical and data collection method (i.e. a 'we have got to make due' situation) but with today's second Q2 GDP release (see also Bloomberg) which match the release of the 14th August it seems that no upward adjustment is in sight. The relevant numbers are here as quoted by Eurostat ...

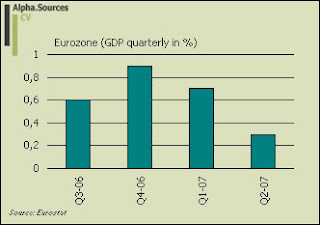

Euro area1 (EA13) GDP grew by 0.3% and EU271 GDP by 0.5% in the second quarter of 2007, compared with the previous quarter, according to first estimates released by Eurostat, the Statistical Office of the European Communities. In the first quarter of 2007, growth rates were +0.7% in both the euro area and the EU27. Compared with the second quarter of 2006, seasonally adjusted GDP rose by 2.5% in the euro area and by 2.8% in the EU27, after +3.2% and +3.3% respectively for the previous quarter.

Let us also for good measure look at the graphical version of quarterly GDP figures ...

Regarding details the picture was reversed compared to Q1 where investment pulled the economy to a very respectable growth rate even as domestic consumption growth was virtually non-existing on an aggregate basis. In the current quarter investment consequently slumped to a -0.2% contraction where domestic consumption resumed an upward yet modest tendency. Also note that exports continues to contribute rather strongly to Eurozone growth rates of course proxied by Germany's thundering export sector. Regarding Thursday's interest rate meeting at the ECB a major upward revision could perhaps have persuaded me to change my call for a hold but this does not seem to be merited at this point.

Regarding details the picture was reversed compared to Q1 where investment pulled the economy to a very respectable growth rate even as domestic consumption growth was virtually non-existing on an aggregate basis. In the current quarter investment consequently slumped to a -0.2% contraction where domestic consumption resumed an upward yet modest tendency. Also note that exports continues to contribute rather strongly to Eurozone growth rates of course proxied by Germany's thundering export sector. Regarding Thursday's interest rate meeting at the ECB a major upward revision could perhaps have persuaded me to change my call for a hold but this does not seem to be merited at this point.